Our Process

Searching for Hidden Value

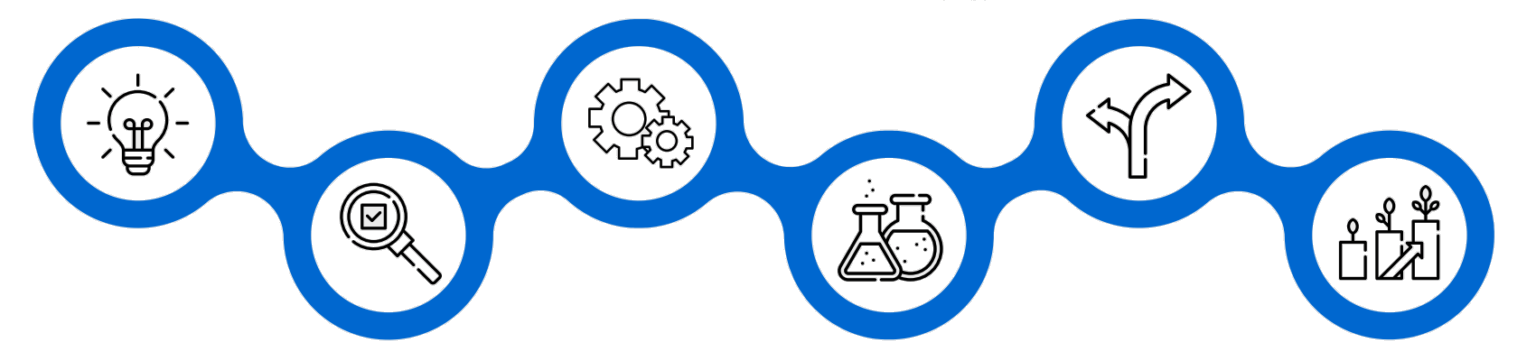

Our Continuous Research Process

Our proprietary six-step research process starts from idea generation up to the actual investment option.

Our aim is to assess assets and markets for themes with the potential for asymmetric returns generation.

Idea Generation

- Key leading indicators

- Private investor activity (venture capital & private equity)

- IPO trends

- Speculative investment discussion

- Non-mainstream ideas

- Asymmetric return potential

Screening

- Quantitative hurdles

- Medium-term return versus risk

- Ensuring accessibility and viability of instruments

- Can research, monitor, and explain

- Sustainable (do no harm)

Theme Selection

- Clear investment rationale

- Objective debate and counter case discussion

- Assessment of risks

- Specialist opinions if required

- Implementation proposal

Theme Validation

- Historic testing and review

- Scenario analysis

- Assess expected outcomes and range of risks versus expectation

- Exit criteria established

Final Selection

- Evidence-based decision making

- Review of investment case

- Market timing and valuation considered

- Challenge session and open debate before final decision

Ongoing Review

- Continuous data- and metric- based monitoring

- Review of market conditions

- Periodic revisiting of investment case

- Consideration of exit basis and timing

- Performance reporting

Some of the best asymmetric investment opportunities around, researched and curated for you.

Important Disclaimer: The data and views provided on this website are for information or educational purposes only. The content is not intended to be a recommendation or solicitation of any kind to buy or sell any asset, instrument, or product, or to adopt any investment idea, strategy, or thesis. Any information provided does not take into account any individual’s knowledge and experience, personal financial circumstances, risk capacity and appetite, or investment aims and objectives. Any investment made or action taken on the basis of any information on this website is taken solely at the risk and responsibility of the investor. The value of your investments, and any income derived from them, may go down as well as up. You may not get back all the money that you invest. If in any doubt, you should seek independent advice from a qualified investment or financial adviser. Discovery Assets is not regulated by the Financial Conduct Authority, or any other regulatory body in another jurisdiction, and does not offer regulated services.